The 2024 Halving Cut Rewards in Half. Miners Are Feeling It in 2025

The fourth Bitcoin halving slashed block rewards from 6.25 to 3.125 BTC. That happened in April 2024. Now, a year later, miners are in survival mode.

Hashrate growth has slowed. Margins are thin. And the mining landscape is reshaping fast. The halving didn’t just impact profits—it’s forcing an industry-wide rethink.

Miners aren’t waiting around. They’re upgrading rigs, shifting locations, merging operations, and selling off reserves. Some are exiting. Others are doubling down.

Let’s break down what’s really going on.

Small Miners Got Hit the Hardest

After the halving, the cost to mine one BTC climbed above $40,000 for many mid-tier operations. That’s painful, especially when Bitcoin’s price isn’t pushing new highs.

Electricity bills haven’t gone down. Rig efficiency matters more than ever. If you’re still running old-gen ASICs, you’re bleeding cash.

As a result, we’ve seen:

-

Smaller farms shutting down

-

Hashrate consolidation around big players

-

Used mining hardware flooding the market

Survival now depends on one thing: scale. Or you need to be in a region with dirt-cheap energy.

Mergers and Acquisitions Are Accelerating

Public mining firms are gobbling up distressed assets. Riot, CleanSpark, and Marathon have all expanded aggressively since the halving.

Why? Simple—buying struggling rivals is cheaper than building new sites. Plus, M&A deals bring instant hashrate gains and existing infrastructure.

Private miners are also joining forces. Pooling resources helps cut costs and smooth out revenue volatility. In a post-halving market, going solo is risky. Power matters. So does partnership.

Expect more mergers in 2025. It’s the fastest way to scale—and survive.

Energy Strategy Is Now Make-or-Break

Electricity remains the #1 operational cost. Miners know this. That’s why they’re relocating.

We’re seeing large migrations toward:

-

Hydro-powered regions (Scandinavia, parts of Canada)

-

Solar and wind projects with excess supply (Texas, Australia)

-

Flared gas operations (Middle East, North Dakota)

Energy deals now define mining strategy. Fixed-rate contracts. Partnerships with utility providers. Or setups where miners act as flexible load—powering down when grid demand spikes.

The miners who thrive in 2025 will be those who locked in cheap, steady power last year.

Selling Bitcoin Isn’t Shameful Anymore

In the old days, “diamond hands” was the mining culture. Hold all mined BTC. Stack sats.

Now? That’s not realistic. With rewards cut in half, many miners are selling more of their monthly output to stay liquid.

It’s not panic selling. It’s risk management.

Some are using BTC sales to pay for new machines. Others to hedge energy costs. Treasury management is evolving—more miners are thinking like CFOs, not just tech guys with racks of rigs.

It’s a shift in mindset. Not weakness.

ESG Is Back in the Conversation

Love it or hate it, ESG (Environmental, Social, Governance) standards are back on the radar in 2025. Institutional investors care. Regulators care.

Public mining companies are publishing sustainability reports, auditing carbon footprints, and investing in renewable energy.

Why? Because they want access to capital.

Want to raise money on public markets? Show clean energy usage. Want partnerships with local governments? Prove you’re not hurting the grid.

The miners ignoring ESG are shrinking. The ones adapting? They’re getting capital.

AI Is Now Competing for Power

One of the unexpected shifts in 2025? AI data centers are driving up energy costs in key mining zones.

In parts of Texas and Georgia, GPU farms and AI compute hubs are competing with Bitcoin miners for the same power contracts. Some utilities are now prioritizing AI clients—they pay more per kilowatt-hour.

This pressure is pushing miners out of high-demand regions. It’s also speeding up innovation in immersion cooling and mobile mining units. Flexibility is now part of the business model.

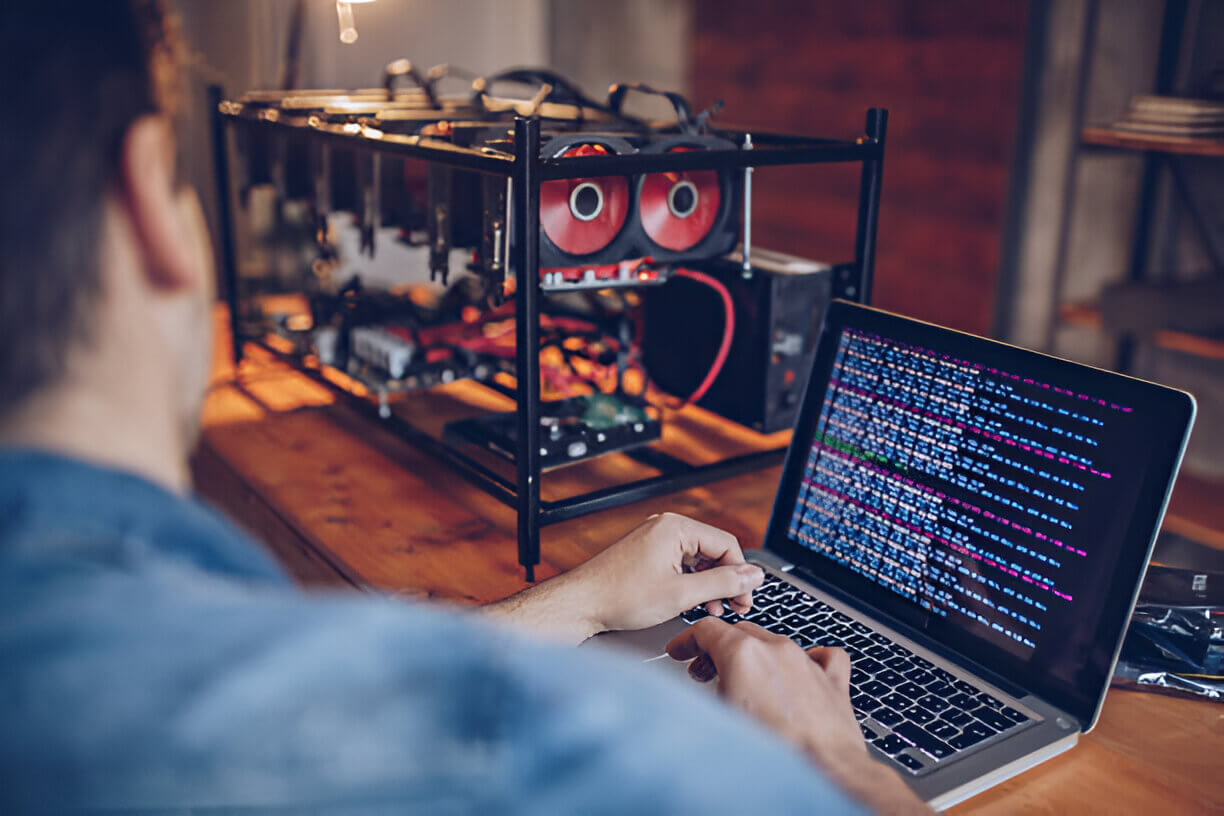

ASIC Tech Arms Race Heats Up

Mining hardware is always evolving. But post-halving, efficiency upgrades aren’t optional—they’re essential.

Bitmain’s S21 and MicroBT’s M60 series are dominating in 2025. These machines offer 25–30% better efficiency than 2023 models.

Upgrading isn’t cheap. But without top-tier gear, you’re out of the game.

Some miners are exploring liquid cooling to overclock safely. Others are customizing firmware to squeeze extra hash out of each watt.

Mining is no longer plug-and-play. It’s become a precision business.

State-Backed Mining Is Quietly Expanding

While private miners restructure, some governments are stepping in.

In 2025, countries like El Salvador, Bhutan, Kazakhstan, and the UAE are backing mining at the state level. Cheap energy. Political support. And national-level incentives.

These projects aren’t headline grabbers—but they’re growing. State mining operations don’t have the same financial pressures. They play the long game.

Private miners will have to compete with these giants. Or partner with them.

What Comes Next: Miner Revenue Models Are Changing

Expect new revenue strategies to emerge.

-

Grid balancing: Miners getting paid to power down during peak demand.

-

Hedging: Derivatives usage is growing. Miners now hedge BTC prices, energy rates, and even hashrate difficulty.

-

Dual-use facilities: Some mining farms are hosting cloud compute jobs alongside ASICs. AI and Bitcoin under one roof.

Miners can’t rely solely on block rewards anymore. Diversification isn’t a bonus—it’s how you survive halving cycles.

Final Word: The Era of Easy Mining Is Over

Bitcoin mining in 2025 is high-stakes, high-efficiency, and brutally competitive. The halving didn’t just reduce income—it raised the bar for staying in the game.

What we’re seeing now is a maturing industry. Fewer cowboy operations. More structured businesses. More CFOs and energy analysts sitting next to engineers.

If BTC pushes past $100K, the pain eases. If it stalls? Only the leanest will last.

The hash war isn’t ending—it’s just entering a new phase. The strong will keep mining. The smart will adapt. And the rest? They’ll fade out quietly.

Tim Warren is a seasoned crypto analyst and lead writer at LatestCryptoInfo.com, bringing over 6 years of hands-on experience in blockchain markets, Bitcoin trends, and altcoin analysis. His insights help everyday investors decode complex crypto movements with clarity and confidence. Tim shares real-time market updates, technical analysis, and expert commentary. Read More